The date of the presentation of the 2016/2017 Budget remains a mystery. Then Minister of Finance has also not yet given a clear indication of his economic orientation. Pre-Budget consultations are ongoing. Meanwhile, members of the public are sharing their proposals through online platforms set up for this purpose.

Publicité

From Vishnu Lutchmeenaraidoo to Pravind Jugnauth, through Sir Anerood Jugnauth, priorities have varied from Smart Cities to renewable energy and ultimately to new economic pillars. Last year, the focus of the budget was the advent of Smart Cities, a theme that has generated a lot of economic and social debates. A year later, some projects have started timidly, while most are still pending. This year, major issues surround the forthcoming Budget. Expectations are indeed high, not only among the public but also within the business community, investors and entrepreneurs. A sluggish atmosphere is being felt in many sectors, and stakeholders are waiting for the Budget to trigger a much awaited boost.

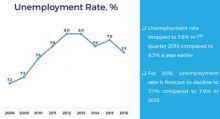

Unemployment

The Chairman of the Board of Investment, Gerard Sanspeur, who is also senior economic adviser, has, in an interview with Inside Africa, an online newspaper, stated that Mauritius is likely to face a full employment situation in two years’ time if private operators play the game. Meanwhile, there are about 46,000 unemployed persons waiting for the opening of the labour market. Among them, about 11,500 (25%) are aged under 25, and this figure includes thousands of graduates. Among the rest, many have not reached the CPE or SC level. The challenge is to create job opportunities both for graduates and for those not holding formal qualifications. Unemployed persons often blame the liberal policy on recruitment of foreigners to work in Mauritius, while employers claim there is a skills gap in Mauritius and shortage of workers in some sectors. Reconciling the two is a daunting task.

Rural tax

The introduction of rural tax is not on the cards. In fact, successive governments have been very evasive on the subject. In 2006, an attempt to introduce such a tax, in the form of the National Residential Property Tax (NRPT) caused such uproar that the then government had to remove it afterwards. Since then, no Finance Minister has had the courage to raise this issue again. Yet, rural tax is now seen as a measure to not only raise revenues for local authorities to improve their services but also as a means to bring greater equality between rural and urban dwellers. Cash-strapped councils are looking for ways to increase their revenues, but rural tax has always been ruled out. On the other hand, it is likely that our future smart cities, most of which are being developed in rural areas, will feature such a tax.

[[{"type":"media","view_mode":"media_large","fid":"19398","attributes":{"class":"media-image size-full wp-image-33387 alignleft","typeof":"foaf:Image","style":"","width":"400","height":"262","alt":"B-16-17--Supermarket"}}]]VAT

The last time that the VAT rate saw an increase was in the period 2000-2005. Since then, no Finance Minister has dared touch the VAT. Although the former government had always criticised the 2003 increase in VAT, it had never taken steps to reduce the rate despite being in power for almost 10 years. Civil society and consumer watchdogs have always pressed for a lowering of the rate, or at least, the imposition of variable rates, for example, from 12% to 15%, depending o the type of products or services. For analysts, a reduced rate will severely impact government’s revenues. Given the current economic and political climate, it is highly unlikely that the VAT will know any change.

Tax deductions

Tax deduction is a boon for many taxpayers. Apart from regular allowable deductions such as dependents or students, medical insurance and interest on housing loans are also deductible. Last year, it was announced that the total investment on renewable energy equipment installed in private housing by individuals will be income tax deductible. This year, we expect more innovative ideas concerning tax deductions.

Investment incentives

As at every Budget, investment incentives are always forthcoming. These incentives encourage domestic investment and foreign investment. With new economic pillars announced, we should expect a series of new measures with attractive incentives. Incentives are also expected in the financial services sector to mitigate the impact of the treaty renegotiation with India. Other important sectors like the manufacturing and agribusiness are in dire need of practical incentives.

[[{"type":"media","view_mode":"media_large","fid":"19399","attributes":{"class":"media-image size-full wp-image-33388 alignright","typeof":"foaf:Image","style":"","width":"400","height":"330","alt":"B-16-17-Real-Estate"}}]]Real estate

In 2015, the then Minister of Finance had condensed the Integrated Resorts Scheme and Real Estate Scheme into a new Scheme, the PDS (Property Development Scheme). One reason was that the IRS/RES encouraged the concept of ‘gated communities’ thus preventing interaction of foreign residents with Mauritians and hampering the integration of non-citizens in Mauritian society. But in practice, the PDS is similar to the IRS/RES except that it has a new clause requiring developers to sell at least 25 percent of residential units to Mauritian buyers (including members of the Mauritian diaspora).

In practice, this has not really lured Mauritian buyers, much to the annoyance of real estate developers, who are likely to find themselves with 25% of unsold units. This clause is further complicated because any Mauritian buyer who invest in such a property may be unable to resell his property to a foreigner if the 25% quota is not maintained, which makes the investment unattractive. However, many developers have made representations to have this clause removed as it is not serving any purpose.

Public debt

The level of the national debt is dangerously oscillating around 60% of GDP. As at end of March 2016, the debt level reached Rs 233 billion. The situation does not permit further borrowings to finance major development such as infrastructure works. However, the creation of jobs will be undermined through lack of development. The situation is still manageable, but for how long?

Decentralisation

The economy badly needs a massive decentralization of public administration, for several reasons: First, to reduce bureaucracy that not only stifles business but also inconvenience consumers of services. Decentralisation also eliminates trips to the capital, thus having a positive impact on road congestion. With a policy of decentralisation, regional job creation gets a new boost as opportunities open up across the country. Decentralisation is also in line with the principle of ‘Participatory Democracy’ currently being advocated by the government, especially through its digital platform Mauritiusfinance.com. So far we have seen centralization trends, for example, Ebène Cybercity and soon-to-come Heritage City.

[[{"type":"media","view_mode":"media_large","fid":"19400","attributes":{"class":"media-image wp-image-33389 alignleft","typeof":"foaf:Image","style":"","width":"225","height":"246","alt":"B-16-17-social-measures"}}]]Social measures

Social measures form an essential part of the Budget. Despite the difficult economic situation prevailing, the Budget will be incomplete without a myriad of popular measures targeting a wide cross-section of the population. Already, speculation is rife and proposals abound. However, some public expenditure is not sustainable in the longer term. With an ageing population, the welfare state is being stretched. Are we going to see a curtailment and a review of subsidies or rather a consolidation of them? Time will tell.

[[{"type":"media","view_mode":"media_large","fid":"19401","attributes":{"class":"media-image wp-image-33390 alignright","typeof":"foaf:Image","style":"","width":"353","height":"286","alt":"B-16-17-offshoring"}}]]Offshoring

The manufacturing sector is facing major challenges. Lack of competitiveness, rising costs of production, dwindling market and scarcity of labour are compelling many production units to move abroad. This sector has not been attracting major foreign investment since long, despite the existence of opportunities in certain niche segments and other areas. Is there something lacking in our promotion exercises? Is there a lack of innovative incentives to attract new players? Other sectors, such as the ICT/BPO may soon see delocalisation trend, especially with the opening up of new technoparks in the region, such as in Ghana and in Madagascar. We need to start preparing for such eventualities.

Privatisation

It is a word that always makes headlines every now and then. Privatisation is eyed by the private sector and feared by trade unions. For some time now, there have been talks about the privatisation of the CWA until the authorities announced that this is not on the agenda. Privatisation may have its own merits and demerits but lately the new buzz term is ‘strategic partner’.

Exchange rate

The rising of the dollar and the Euro against the rupee in recent times will have a bearing on the prices of imported goods, but will be beneficial to our exports and tourism. However, a depreciation of the rupee worsens our debts taken in dollars.

SMEs

[[{"type":"media","view_mode":"media_large","fid":"19402","attributes":{"class":"media-image aligncenter size-full wp-image-33391","typeof":"foaf:Image","style":"","width":"400","height":"297","alt":"B-16-17-SMEs"}}]]Making Mauritius a nation of entrepreneurs… The launch of the One-Stop-Shop and Maubank has not really encouraged the emergence of an entrepreneurial nation. According to official figures, very few projects have been approved under the various ‘Schemes’ announced. Furthermore, there has been no study to analyse the reasons for the timid takeoff. Entrepreneurs are failing to seize opportunities that are arising. The reasons? Lack of information? Poor networking? Lack of entrepreneurial skills? Cumbersome procedures ?

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !