Despite the uncertainty in the world economic order and adversity that the country faces in respect to high fuel cost, decreasing sugar proceeds, competition in the tourism sector and erosion of incentives in the financial sector, Hon. Pravind Kumar Jugnauth remains cautiously optimistic and opts for continuation on his transformative program. He proposes measures to alleviate poverty, enhance quality of life and provide social incentives as he presents his sixth budget and second in the capacity of Prime Minister and Minister of Finance.

Publicité

The fourth budget of this Government during its current mandate addresses both the key social and economic concerns that the country faces whilst also bringing many sweeteners to boost the general feel-good factor for the population. He has been consistent with previous years budgets on the social front by improving the household discretionary income through reduction of fuel and gas cost and reduction of income tax for the low and middle-income earners. Furthermore, he has provided many incentives to promote the welfare system, enhance participation of women in the economy and strengthen support to elderly and reduced abilities. He has also committed to 24/7 water supply without price increase which has been a long debate.

His transformative program to build a high-income country is based on seven pillars encompassing: youth and their future, Innovation and accelerating adoption of Digitisation, import substitution plus export led production, strategic and modern infrastructure, sustainable development, lifting the standard and quality of life, creating an inclusive and caring society.

However, it leaves some critical and salient issues to be addressed separately due to their complex nature and far-reaching and wide implications. These include, amongst others, the rejuvenation of the cane Industry, blueprint of the financial sector and the deficit pension situation which risks deteriorating further with the ageing population.

The budget places a strong emphasis on the infrastructure development which includes land transport development, the airport and port developments and facilities. These aim to improve both connectivity of the country to the outside world and within the country.

Besides infrastructure, an important sum is allocated to resource capability building and employing people. He has allocated as much as one billion rupees in supporting 14,000 unemployed to be re-skilled and to get the foundation to become entrepreneurs or attractive for employment. He further allocates funds for capability and institutional framework for the country to adopt innovative practices and emerging technological solutions.

Conscious that the traditional businesses such as agriculture and manufacturing need a deep revamp, the Honorable Minister sets out to embrace new development pathways like digital economy including Artificial intelligence, big data, blockchain technologies, Fintech and the ocean economy.

In the aftermath of the backlash faced by the financial sector, the Hon. Minister took the bold step to eliminate the Deemed Tax Credit of GBC 1 and replace it with a regime that converge with domestic companies where 80 % of specified income will be exempted from income tax. Furthermore, GBL2 structure will be abolished completely with a grandfathering provision and push organizations to comply with more substance and enhanced conditions. This will build credibility for the sector and address concerns of OECD.

The program takes steps to diversify agriculture in the wake of the cane Industry facing adverse business environment specially providing alternatives to the small planter’s community and households. This will contribute to the food security objectives. To reverse the downward trend of the manufacturing sector, the Hon. Prime Minister is planning the building of more business parks and developing new markets including Africa. Incentives such as loan guarantee facilities to support cross border investments have been provided as well as a 5yr tax holiday for both project developers and project financing institutions under the eligibility of the Mauritius Africa Fund. Measures have been taken to broaden the tourism product portfolio and to diversify to new markets as well as promoting local art, craftmanship and the film industry.

The SME have also benefitted from financing support and taxation relief which will help both start-ups and established businesses seeking support and growth.

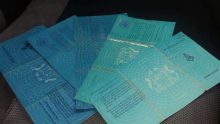

There are two-tier incentives enabling foreign investors to obtain either Mauritian citizenship or passport. However, caution must be exercised that this scheme does not cannibalise existing incentives for real estate schemes like IRS, PDS, Smart Cities as foreigners can now buy anywhere after being granted citizenship.

The Budget addresses the quality of life where substantial means have been allocated to healthcare, education, gender empowerment, sports, housing and safety, leading to unity and harmonious living. One of the biggest surprise of this budget remains the decrease of the income tax from 15% to 10% for income earners of less than Rs 650,000 annually.

The overall budget has the merit of keeping the macroeconomic indicators positive, despite all these social measures, tax reliefs, incentives to promote investments, build capability and develop infrastructure. However, one prerequisite of the success of the budget resides in the successful implementation of all the programs and provided that the expected benefits materialize and are not subject to adverse shocks including the challenges of the sugar sector. Whilst the measures in the budget are seductive, one need to be cognizant that the targets announced in the previous budgets were not achieved.

For the economic targets to be met, we need appropriate implementation and monitoring.

Notre service WhatsApp. Vous êtes témoins d`un événement d`actualité ou d`une scène insolite? Envoyez-nous vos photos ou vidéos sur le 5 259 82 00 !

![[Info Soirée] : Dossier Chagos : Trump dit YES](https://defimedia.info/sites/default/files/styles/square_thumbnail/public/tb.jpg?itok=o1JtJpUf)